Lindsay Goldberg Enters into Agreement to Sell Pixelle Specialty Solutions LLC to H.I.G. Capital

News General news

Leading provider of fiber-based specialty solutions positioned for continued growth and investment

Pixelle Specialty Solutions Holding LLC (“Pixelle” or the “Company”), a leading provider of fiber-based specialty solutions in North America and portfolio company of Lindsay Goldberg, announced that it has signed a definitive agreement to be acquired by an affiliate of H.I.G. Capital (“H.I.G.”), a leading global alternative investment firm with $48 billion of equity capital under management. Terms of the transaction were not disclosed.

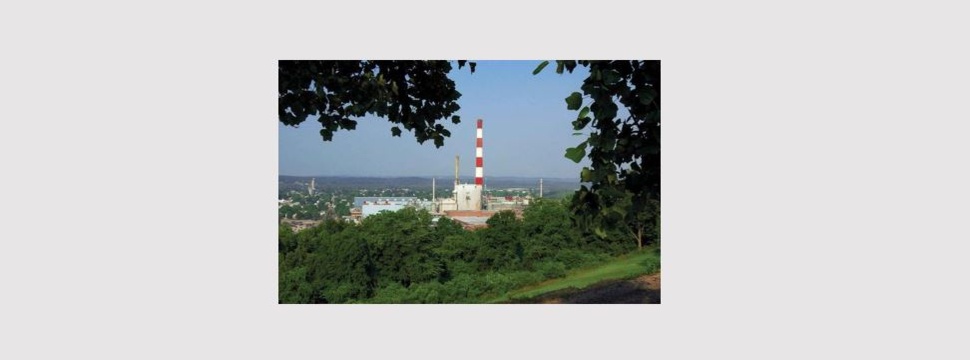

Pixelle was formed in 2018 by Lindsay Goldberg, a private investment firm that focuses on partnering with families, founders and management teams seeking to actively build their businesses. Pixelle has built an industry-leading four-mill specialty paper platform with mills in Chillicothe, OH; Jay, ME; Spring Grove, PA; and Stevens Point, WI. Collectively the mills operate 11 paper machines and produce more than one million tons of paper annually.

Timothy Hess, Pixelle’s Chief Executive Officer, said, “Together with Lindsay Goldberg, Pixelle has developed a broad, innovative portfolio of industry leading brands across the specialty papers and sustainable packaging markets. In under four years, we have transformed Pixelle into the leading specialty-focused paper producer in North America through three strategic acquisitions and successful implementation of a continuou s improvement program. We thank Lindsay Goldberg for their partnership and look forward to our next chapter with H.I.G. Capital.”

Russell Triedman, Managing Partner at Lindsay Goldberg, added, “We are very pleased to have partnered with Pixelle’s management to execute on a strategic plan to position the business as a true market leader and partner of choice to its customers. We are especially proud to have worked with Pixelle’s management team to advanc e the company’s sustainability initiatives, including responsible sourcing practices, r educed energy consumption, and the continued development of environmentally friendly products. Pixelle is poised for continued success and we wish Tim and his team the best.”

Credit Suisse served as lead financial advisor to Pixelle on the transaction. Houlihan Lokey also served as financial advisor to Pixelle. Cravath, Swaine & Moore LLP served as legal advisor to Pixelle. Credit Suisse and Macquarie Capital are providing committed financing in support of the transaction. Macquarie Capital and Jefferies acted as financial advisors and Ropes & Gray LLP provided legal advice to H.I.G. The transaction is subject to customary closing conditions, including regulatory approvals, and is expected to close in the second quarter of 2022.