bvdm Economic Telegram June 2022: Business climate cools down in the middle of the year; rising energy prices and possible gas shortage cause concern

News General news

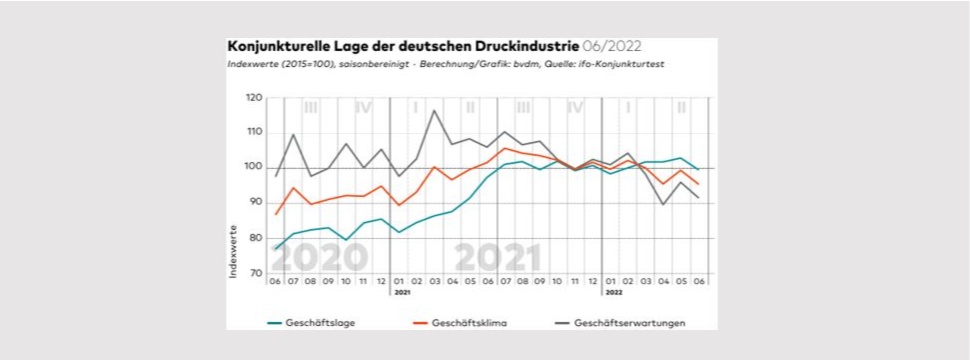

After recovering somewhat in May, the business climate in the German print and media industry slipped again in June. The business climate index calculated by the Bundesverband Druck und Medien (German Printing and Media Industries Federation) fell by a seasonally adjusted 3.9 per cent compared to the previous month to the level of April. The index stood at 95.5 points, some 6 per cent below its year-earlier level. The continuing effects of the Ukraine war, above all rising energy prices and uncertainties in gas supplies, as well as the continuing tense situation in supply chains, are clouding business expectations.

In June the printing and media companies surveyed by the ifo Institute assessed both their current business situation and their expectations for business development over the next six months as visibly worse than in the previous month. The values for the business climate therefore declined significantly. The values of the current and expected business situation determine the development of the business climate, which is a good leading indicator for the production development of the print and media industry.

After rising in May, the seasonally adjusted business situation index lost 3.2 per cent in June compared to the previous month. The index stood at 99.6 points, the lowest seasonally adjusted level since January 2022, while the proportion of companies assessing the current business situation as good rose by 1.1 percentage points year-on-year. At the same time, the proportion of dissatisfied respondents fell by 3 percentage points. Thus, about 61 percent of all respondents confirmed that the business situation remained unchanged in June. Although this means that the index is 2.2 percent above its level of the previous year, the inflation-related inhibition of consumer sentiment is having an impact on the order backlog and production figures. 31.2 percent of all companies surveyed assess the order backlog as "too small" overall and 18.4 percent see a decline in demand compared to the previous month.

The dominant theme in business expectations in June was concern about an impending gas shortage. Although the acute occurrence of a gas shortage is not expected for the time being, filling the storage reserve and ensuring security of supply in winter is proving increasingly problematic. The business expectations index fell by 4.6 percent in June compared to May and is still around 2 percentage points above the annual low of March 2022. At 91.6 points, it is also 13.5 percent below the previous year's level. Some 29 per cent of respondents in the print and media industry expect the business situation to deteriorate further in the next six months. 62 per cent expect the business situation to remain unchanged, while only 9 per cent anticipate an improvement. The seasonally adjusted balance fell by around 8 percentage points in June to -23 percentage points. Besides the well-known strains on supply chains, energy and gas prices are a cause for concern. Due to the measures taken to secure gas supply, gas prices are expected to rise in the coming months, which will be passed on through the utilities. This will affect the print and media industry both directly and indirectly through the energy intensity of its upstream products. Consequently, business expectations are additionally dampened by concerns about rising prices of intermediate products.