bvdm economic telegram January 2024: Business climate starts the new year unchanged

News General news

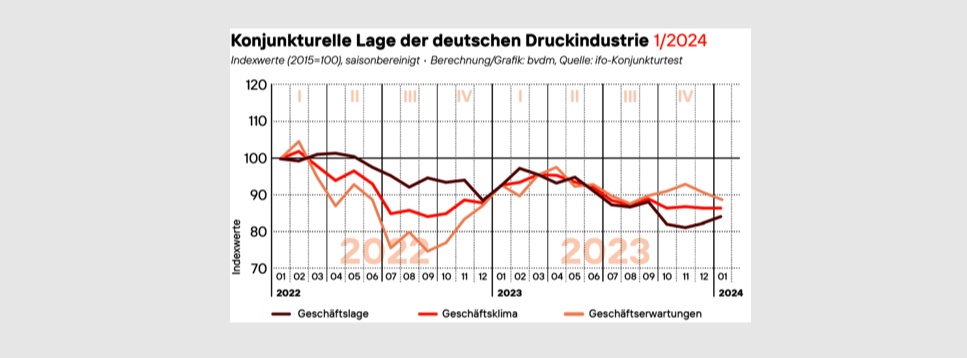

At the start of 2024, the seasonally and calendar-adjusted business climate in the German print and media industry remained unchanged. While the business outlook for the next six months declined slightly, assessments of the current business situation rose slightly. The business climate index calculated by the German Printing and Media Industries Federation stagnated at the previous month's level, adjusted for seasonal and calendar effects. At 86.6 points, the index in January was around 6.7 per cent below the previous year's figure.

In January 2024, the decision-makers at printing and media companies surveyed by the ifo Institute assessed their current business situation as slightly better than in the previous month. In contrast, they were more pessimistic about developments in the coming months. The characteristics of the current and expected business situation determine the development of the business climate, which is a good leading indicator for production development in the print and media industry.

The seasonally and calendar-adjusted business situation index recorded a slight increase in January 2024 compared to the previous month and, at 84.3 points, was around 2.1 per cent higher than at the end of 2023. However, at around 9.1 per cent, the index was still significantly below the previous year's level. Around 71 per cent of the entrepreneurs surveyed reported obstacles to production in January. At around 47 per cent of companies, the lack of orders is once again the most significant factor and is around 2 percentage points above the previous year's figure. Companies' capacity utilisation was correspondingly low. In January, the average utilisation of production capacity was 74.6%, around 3 percentage points below the previous year's figure - an indication of continuing overcapacity in the market for printed products. In contrast, the trend for skilled labour is somewhat more positive. In January, around 29 per cent of companies reported restrictions due to production constraints caused by a shortage of skilled workers. This corresponds to a decrease of 16 percentage points compared to the previous year. It can be assumed that this is primarily due to the economic situation in the sector and the associated layoffs or reduced demand for labour.

Adjusted for calendar and seasonal effects, business expectations in January were more pessimistic than in the previous month; at 88.9 points, the calendar and seasonally adjusted index was around 2.1 per cent below the previous month's level and 4.3 per cent below the previous year's level. Only 6 per cent of companies stated that they expect their business situation to improve significantly in the next six months, while around 35 per cent expect it to deteriorate. However, the majority of respondents (59 per cent) expect the business situation to move sideways over the next 6 months. The production plans for the next three months also do not indicate a significant improvement in the economic situation for the time being. On balance, these remain clearly in negative territory at around -22 percentage points and are therefore around 13 percentage points worse than at the start of the previous year. The expected employment trend for companies is also correspondingly negative. With a balance of -31 percentage points, companies increasingly expect to further reduce their personnel capacities in the coming months.