bvdm economic telegram August 2022: Business outlook less pessimistic; low order backlog clouds business situation

News General news

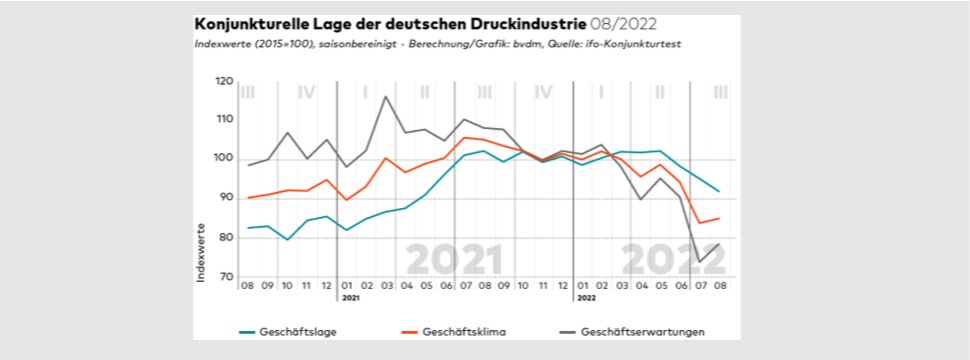

After slumping in July, the business climate in the German print and media industry turned slightly upward in August. The business climate index calculated by the Bundesverband Druck und Medien (German Printing and Media Industries Federation) rose by a seasonally adjusted 1.3 percent compared with the previous month. However, at 85.0 points, the index was down around 19.2 percent on its year-earlier level. The recent decline in orders, particularly in the advertising segment, continues to affect the printing industry and is visibly clouding the business situation.

In August, the decision-makers at print and media companies surveyed by the ifo Institute assessed their current business situation as worse than in the previous month. At the same time, their expectations for business development over the next six months were slightly less pessimistic than in the previous month. The values for the business climate therefore increased slightly. The characteristics of the current and expected business situation determine the development of the business climate, which is a good leading indicator for the production development of the print and media industry.

Having already been in decline since June, the seasonally adjusted business situation index lost around 3.5 percent in August compared with the previous month. The index stood at 91.9 points and fell to its lowest seasonally adjusted level since May 2021, 10.1 percent below the figure for the same month a year ago. However, a year-over-year increase of 8.1 percent was still observed for the 2022 cumulative averages. Cost-cutting and the weakening retail sector due to inflation are reducing order volumes and hitting advertising print in particular. The high cost burdens pose a dilemma for companies in the print and media industry. On the one hand, cost increases for input products and operating materials are forcing companies to raise prices, while on the other hand, price developments are inhibiting demand from customers who are also looking to cut costs. Accordingly, 52.1 percent of respondents rated the development of demand in the previous month as "negative". 44.1 percent assessed the development as unchanged and only around 3.8 percent as positive. In addition, 49.1 of all companies surveyed stated that their order backlog was "too low" in August.

The expectations of companies in the print and media sector continue to be shaped by developments on the procurement markets and in the overall economy. Rising prices for electricity and gas and the resulting increases in printing paper prices continue to weigh heavily on expectations. However, the outlook was less pessimistic than in July. For example, a slightly positive trend can be seen in the production bottlenecks caused by material shortages. The now good gas storage levels also somewhat reduce the risks of a gas shortage in winter. The business expectations index rose by 6.4 percent in August compared with July, and is now around 5.7 percentage points below the Corona low of April 2020. At 78.5 points, it is also 27.4 percent below the previous year's level. However, this should be assessed in the context of the statistical basis. Due to the good values of the prior-year month, the year-on-year comparison is thus particularly high. Around 51 percent of respondents in the print and media sector expect the business situation to deteriorate further over the next six months. 39 percent expect the business situation to remain unchanged, while 10 percent anticipate an improvement.