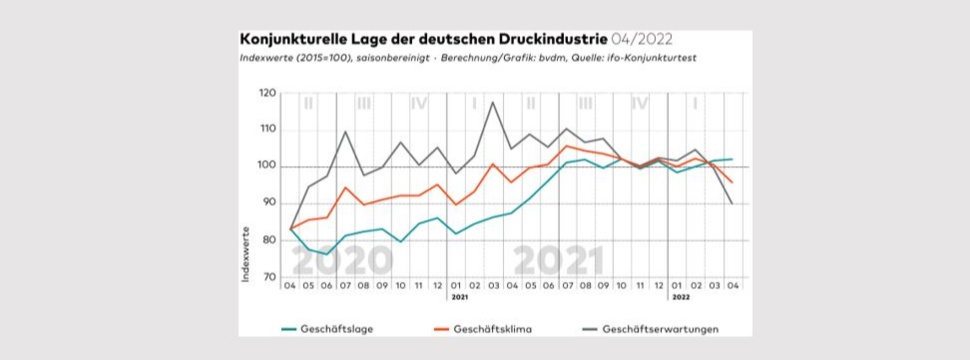

bvdm-Economic Telegram April 2022: Ukraine War Visibly Dampens Business Expectations; Business Climate Index and Business Expectations Drop

News General news

After the business climate in the German print and media industry had already cooled in March, it slumped in April. The business climate index calculated by the German Printing and Media Industries Federation fell by a seasonally adjusted 4.4 percent compared with the previous month. It thus stood at 95.8 points, slightly below its previous year's level for the second time in succession this year. The impact of the war in Ukraine and fluctuations in energy prices led to more pessimistic business expectations among companies, many of which are apparently currently anticipating a further worsening of supply bottlenecks and cost increases for intermediate goods.

In April, the printing and media companies surveyed by the ifo Institute rated their current business situation as good as in March. However, their expectations for business development over the next 6 months were considerably weaker than in the previous month. The values of the current and expected business situation determine the development of the business climate, which is a good leading indicator for the production development of the print and media industry.

After the seasonally adjusted business situation index had risen somewhat in March, this gain weakened in April. Although the index still stood at 102.1 points, around 16% above its level in the previous year, it stagnated almost completely compared with the previous month of March. The main reason for this is the continuing production bottlenecks. Thus, 91% of all companies surveyed complain about serious impediments to their production. Of these, 82% complain in particular about the ongoing shortage of materials. This is further exacerbated by the impact of the Ukraine war on producer price increases for intermediate goods and the additional pressure on already strained supply chains. In addition, the increased production compared to the previous year, leads to an increased demand for skilled workers and thus to a shortage of qualified personnel in the print and media industry. This is currently difficult to compensate for. Around 60% of all companies affected by production constraints see this as a threat to their production.

The effects of the Ukraine war continue to seriously dominate the expected business development of print and media companies over the next 6 months. The business expectations index lost 8.7 percent in April, further intensifying its downward trend from March. At 90.0 points, the seasonally adjusted index is around 16% below its year-earlier level and is only around 6.7% above its Corona low of April 2020. This quantifies the sharpest year-on-year decline since the outbreak of the Corona crisis. Around 42% of respondents in the print and media sector expect the business situation to deteriorate in the next 6 months. Only around 7% expect the situation to improve. The seasonally adjusted balance thus fell by around 16 percentage points in April and now stands at -26 percentage points. Compared with a year ago, this is a drop of around 33 percentage points. The gloomier business expectations continue to be led by the additional pressure on supply chains and rising prices for intermediate goods. Against the backdrop of the Ukraine war, there are also uncertainties about the price situation and security of supply for natural gas and energy. Many companies obviously see the risk of production losses, due to an aggravation of supply bottlenecks and additional cost burdens.